how to calculate taxes taken out of paycheck in illinois

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

For salaried employees divide each employees annual salary by the number of pay periods you have over the course of a year.

. Illinois Resources Illinois calculators Illinois tax rates Illinois withholding forms More payroll resources Illinois Hourly Paycheck Calculator Gusto. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Compare Prices Find the Best Rates for Payroll Services. Taxes Paid Filed - 100 Guarantee. If your employees have 401 k accounts flexible spending accounts FSA or any other pre-tax withholdings subtract them from gross wages prior to applying payroll taxes.

This calculator is intended for use by US. Make Your Payroll Effortless and Focus on What really Matters. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

Ad Access Tax Forms. First you need to determine your filing status to understand your tax bracket. Switch to hourly Salaried Employee.

Easy To Run Payroll Get Set Up Running in Minutes. Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

Change state Check Date General Gross Pay Gross Pay Method. Single Married Filing Jointly or Widow er Married Filing Separately. The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022.

Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inIllinois the net effect for those individuals is a higher state income tax bill in Illinois and a higher Federal tax bill. It can also be used to help fill steps 3 and 4 of a W-4 form. Median household income in Illinois.

Yes if you are a resident of Illinois you are subject to personal income tax. Supports hourly salary income and multiple pay frequencies. Step 1 Filing status There is 4 main filing status.

How do I calculate taxes from paycheck. Switch to Illinois hourly calculator. How much is 15 an hour after taxes.

Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. How to calculate taxes taken out of paycheck in illinois Tuesday July 5 2022 Taxable Income in Illinois is calculated by subtracting your tax deductions from your gross income. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds.

Employees who file for exemption from federal income tax must still have Medicare taxes withheld from their payroll checks. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

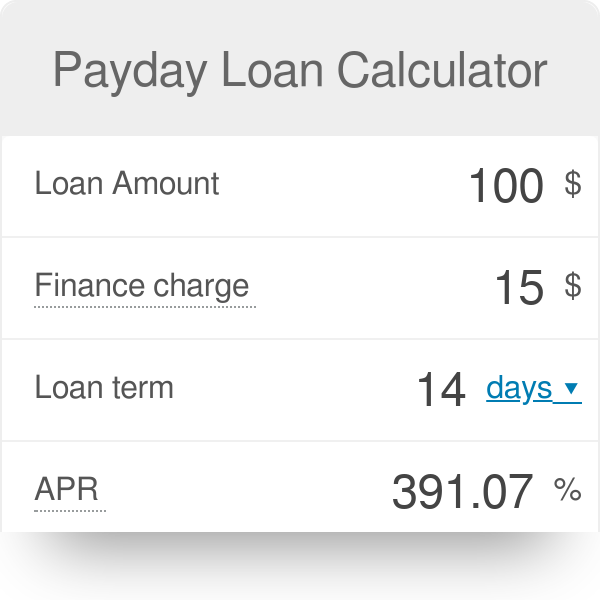

Complete Edit or Print Tax Forms Instantly. Personal income tax in Illinois is a flat 495 for 20221. The Illinois paycheck calculator will calculate the amount of taxes taken out of your paycheck.

Paid by the hour. Taxable Income in Illinois is calculated by subtracting your tax deductions from your gross income. Taxes Paid Filed - 100 Guarantee.

What percentage is taken out of paycheck taxes. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Calculate any pre-tax withholdings.

Exclusive Pure Solid Credit Cards Made From Precious Metals Credit Card Design Credit Card Payoff Plan Business Credit Cards. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. State Date State Illinois.

Choose Your Paycheck Tools from the Premier Resource for Businesses. Ad Get the Paycheck Tools your competitors are already using - Start Now. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. You can even use historical tax years to figure out your total salary. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Strategies For Managing Your Tax Bill On Deferred Compensation Turbotax Tax Tips Videos

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Idaho Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Estimated Tax Payments For Independent Contractors A Complete Guide

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

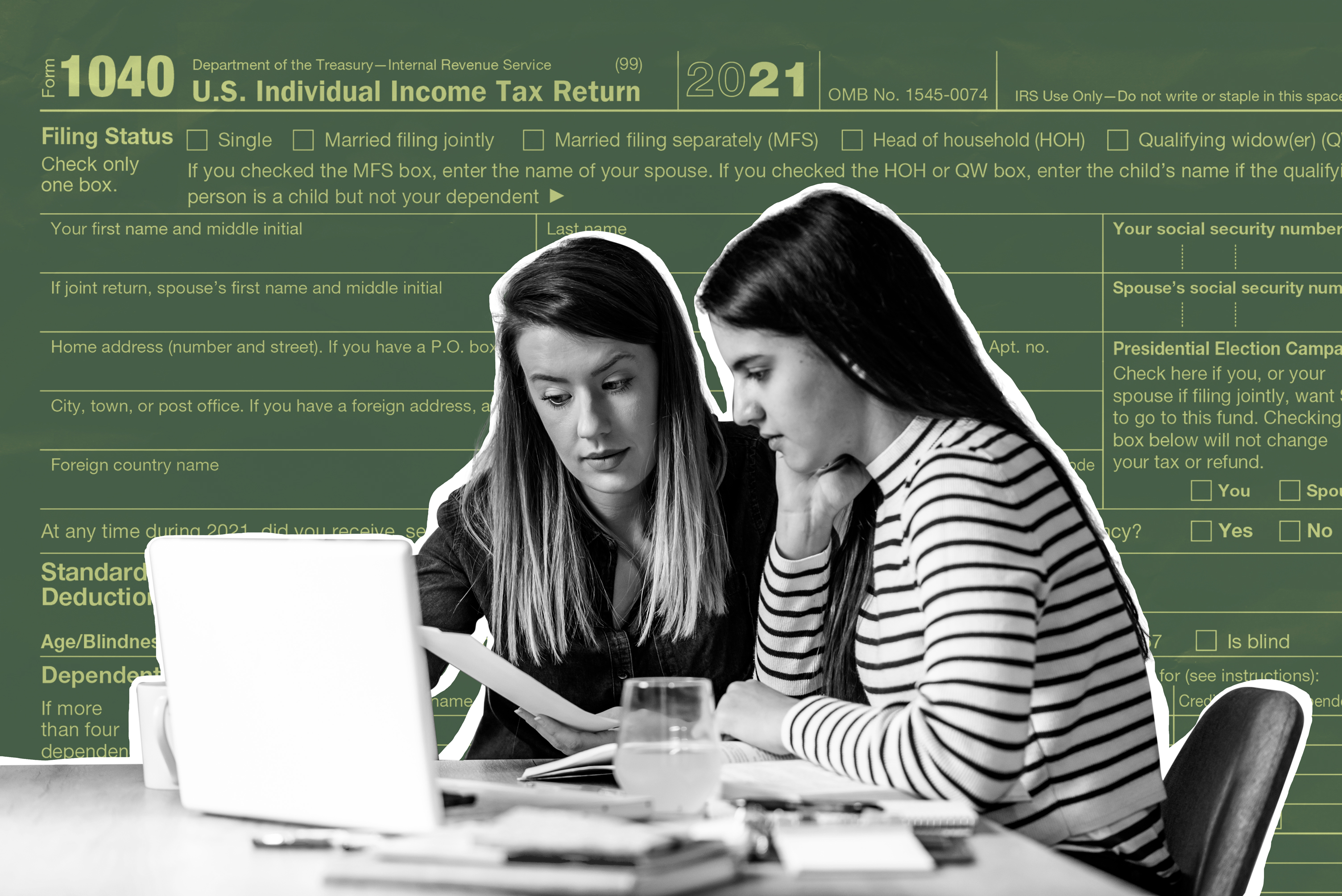

W 4 Form How To Fill It Out In 2022

Value Of Volunteer Time Report Independent Sector Resources

Arkansas State 2022 Taxes Forbes Advisor

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Why Teenagers Should File A Tax Return Money

How Bonuses Are Taxed Turbotax Tax Tips Videos

Are Relocation Expenses For Employees Taxable When Paid By An Employer

Estimated Tax Payments For Independent Contractors A Complete Guide

Should We Include Government Mandated Coronavirus Pto When Calculating Company Contributions

/SeverancePay-59776538ca584ab8b58f696cf3112d3c.jpeg)